The dream, the nightmare and the reality of running your own business…and what to do about it.

Running a business is not for the faint hearted. So why do we do it?

We do it because we too “have a dream”.

I’ve heard all sorts of reasons and dreams in over 30 years of running my own businesses and consulting with clients. The dreams are as varied and individual as there are business owners. A solid retirement pot and financial future is usually a given. It may also include more time with the family (good luck with that one), travel, the Aston Martin (one of mine), a house in the sun (another one of mine…your thoughts betray you young Skywalker!) or a passion project.

The dreams can typically be summarised by:

- More money

- More time

- More contribution

- Less stress

To keep it simple we call it Freedom To Choose.

If you’re a business owner, how about you? How’s it going? Are you “Living your dream?”

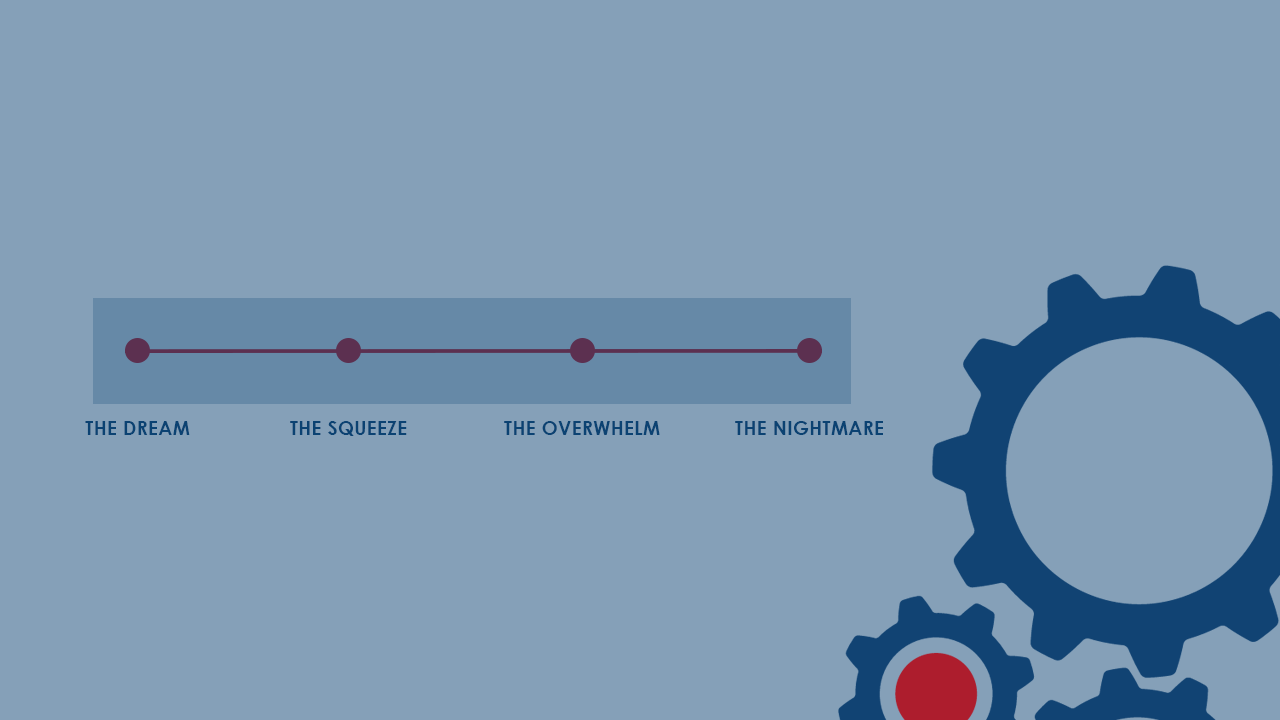

Whatever your dream is however, if you’ve been a business owner for even a short time, you’ll probably know that the dream and the reality can be quite different. The reality of any business for its owner, sits somewhere on a continuum between the dream and the nightmare:

- The dream - The owner is creaming it with growth, profits and cash flow and loving life

- The squeeze - The business underperforms and things begin to press in

- The overwhelm - The business becomes distressed overwhelming the owner

- The nightmare - The owner loses control and everything they’ve worked so hard for, often at major personal loss and risk

1. The dream

When things are going well and you’re creaming it, life is great and you love your business. If that’s you, awesome. Living the Dream!

If that’s not though, don’t worry, it’s actually far less common than you might think. Business owners are normally quite good at presenting a successful image whether it’s true or not!

I shall never forget being impressed as I turned up to a new client’s office, built into the roof of a huge triple garage in the grounds of an amazing house and gardens. It was in the suburbs of London so must have been worth £m’s. But then I looked at his accounts! Now that was a totally different story. Talk about the Emperor’s New Clothes. I knew it was bad when we went to see his bank manager and another manager came in and took notes!

I’ve worked with SME business owners who are seriously creaming it. But if that’s not you, do know that it’s not as common as you think. All that glitters is definitely not gold.

2. The squeeze

There are all sorts of challenges in business which conspire to knock you off the pedestal and start to squeeze you as the owner. The early signs of underperformance of a business might be difficult to spot, particularly if you don’t have good feedback systems. If you don’t take action, you’ll be increasingly aware of things popping up at the edge of the radar screen.

For me I feel it first in my gut. If that happens I’ve learnt to stop and ask myself what’s going on. The squeeze comes from all sorts of directions; making payroll, an unexpected liability, losing a good client, staff throwing their toys out of the pram to name but a few. If you haven’t felt the vice pressing in on you, you haven’t been in business very long.

3. The overwhelm

If you don’t or can’t deal with those pressures and other tectonic plates begin to move, the pressure becomes overwhelming. Fear begins to settle in. You’ll start to struggle to sleep at night. It’ll be tough days at work fending off creditors and having to be positive for your staff. You’ll then come back in need of some TLC and the spouse starts to give you grief as there’s not enough money coming in. Life is frankly s**t and your energy and mojo seems to desert you when you need it most.

I’ve seen some business owners crumble as pressure increases and others suck it up and thrive with the pressure. One of the things I look for in any business I’m investing in, is how well I think the owner and key management team handle pressure.

4. The nightmare

As things go from bad to worse, the dream becomes a nightmare as crisis and imminent collapse settle in. Sometimes this can be stabilised and turned around. Other times management lose control of the business and the business goes under, often with other players calling the shots.

Paradoxically it can be a real relief to the Directors, when they get advice from an outside professional to put the business under. Having been through this myself several times with businesses which I’ve poured my heart, soul and money into I can tell you this involves deep and lasting pain for both the people directly involved and also their spouses and families.

So how do you avoid the pain and keep your business on the healthy side of this continuum?

Business involves risk as well as opportunity. There are a lot of moving parts, many outside of your control. Things will go wrong. A business situation can change very quickly. I think it was Margaret Thatcher who said “ a week is a long time in politics” So with business. If Covid has taught us anything it is that things can change very quickly. So how do you mitigate against the risk of things going wrong and deal with them when they do?

Regardless of where your current reality is, I’d like to suggest some steps to help you:

1. Press pause and take stock before you plan your next steps and priorities

The more pressure a business is under the greater risk the owner and directors will make knee jerk decisions based on emotion.

You may find our Business Diagnostic framework below, which we call The Rocketⓒ, helpful to organise and capture your thoughts.

One of the first things we do when we look at a business is to evaluate each of its functions against the Rocket ⓒ. Getting all the issues out on one page and rating each component 1 to 5 may help you get perspective on where the root cause of the issues are.

In its fullest form we do this in a day off site with the company directors and take them systematically through each component of the business. It’s a software driven process with a suite of questions to generate discussion and debate regarding how effective the business is in each area. We then grade each component area and its subcomponents. The software then generates powerful, easy to understand images of each area like the example below.

We’ll introduce these and other powerful frameworks in more detail in later blogs but bringing the key players in the business together and leading them through a structured analysis of the business is very powerful to get people on the same page and generate buy in. I’ve seen the process turn warring partners and directors around and get alignment on the key priorities to be done. You need to get your team in agreement on what the problems are before you’ll have any luck getting them to agree to the solutions!

For now though you can get rough agreement on strengths and weaknesses in your business by spending even 15 minutes grading each of the Rocket components in your business.

2. Focus on profit and cash flow first

Having captured the issues pressing in for your attention and pressed pause however, I’d like to suggest there is one component you need to deal with and address first, Finance and Cash Generation.

I don’t care how good your product, your people, or anything else is in your business. If you are not in control of the generation of strong profits and cash, you are living on borrowed time. If you don't have a strong foundation of profitability and cash, it doesn’t matter what you do in the other areas, you're building your business on shifting sand and you're just going to spend time lurching from one crisis to another.

In fact if you're not in control of your finances, I’d even go so far as to say you might do something normally good (e.g. go out and generate more sales) but done at the wrong time and in the wrong way can get you deeper into the hole, not out of it.

How this happens: A case study

Let me give you an example from an e-commerce client a few years ago who lost control of his business. This client started selling products online in the early days of Pay Per Click (PPC) when it was relatively easy to make a profit. Because he got paid on his merchant account within 3 days and didn’t pay his suppliers for 45+ days, he had 42 days of cash from the sale before he had to pay for it. The more of that money he invested in PPC just cranked his sales giving him more cash in the short term. He was doing £2m+ turnover in the first 18 months of operation and thought he’d found a licence to print money. Unfortunately for him, in that 18m the cost of the PPC got a lot more expensive. So expensive in fact that he made a gross loss on some of his product lines and far less margin on others. He could see loads of cash in the bank, but because he didn’t have accurate accounts (prior to my involvement!) he didn’t have control of how much profit or loss he was making.

Eventually the losses caught up with him and he was no longer able to pay his suppliers for more product. Whilst I was able to help get the accounts far more accurate, the business was too far gone to save. He understood his cashflow but not his profitability...and he paid the price. In this case more sales didn’t do him any good. It only accelerated the downfall of that business.

So how do you avoid this in your business?

You have to have strong financial reporting, controls, profitability and cash flow as the foundation of your business, before you worry too much about anything else. Strong profit and cash flow can eventually sort everything else.

Well duh! Tell me something I don’t know!

Yep, fundamental I know. However you’d be surprised at how many business owners I meet who:

- Don’t get monthly management accounts telling them how much profit they made last month. Instead they rely on monitoring the bank account and wait until 6 months after that year has ended before their accountant tells them how much profit they did or did not make

- Don’t really understand their accounts and how the P/L, B/S and Cashflow work together

- Don’t know how to tell if management accounts are robust and accurate and take their accountant’s word for it

- Don’t have profit and cash flow forecasts and budgets giving them advance notice of what’s coming down the track so there are no surprises at a time when they can take corrective action and do something about it

Don’t just take my word for it.

Source: smallbiztrends.com

Industry research reveals:

- 30% of small and medium sized businesses are actually losing money. So clearly, they've not put profit first.

- The next 30% are breaking even so they’re not making a profit either

- That only 40% are actually profitable!

- Of those 40%, anecdotally I would say that half are reasonably profitable, and half are absolutely creaming it. I’ve seen small and medium sized businesses making so much money it's unbelievable.

Working with business owners and knowing how hard they work and how much blood, sweat, tears and treasure they put into their business, over many years, I find it tragic that almost 60% are not making money. When that’s the case and you can’t build a strong balance sheet, it’s no wonder that when you get a big shock like we've had in the economy in the last nine months, so many businesses go bust. They're existing hand to mouth even before the world changes. As Warren Buffett once said, “When the tide goes out you see who’s been swimming without their underpants on”!

The good news is, it doesn’t have to be that way. This is the first in a series of blogs about how to grow profit and cash in your business. With regard to this blog however, I’m going to wrap up with two questions I’d like you to ask yourself:

- How is your business doing? Where is it on the business performance continuum from The Dream to The Nightmare above?

- Whatever the other presenting issues in the business, are you making significant, consistent and predictable, profit and cash flow?

If you’d like some help to think that through, take our Profit and Cashflow Scorecard. Don’t worry, it won’t cost you any money. It will cost you 5 minutes of your time. It will give you a high level view of how good your business is at generating profit and cash flow with some ideas of how you might improve that.

If you take the time to do that, we’ll also send you our Free Profit Calculator Tool. We’ll go through the Profit Calculator in more detail in a later blog, but in essence it will help you, rather than doing what most businesses do when (and if) they budget for the next year, our tool will help you set a Profit Target for the next 12 months and show you how to reverse engineer your sales, margins and overhead to achieve that.

We hope that might help you increase the profit, cash flow and return you as a business owner get from your business and give you the platform to live your dream.

To your success.

Shaun

Ready to start planning for profit?

Complete our free Profit and Cashflow Scorecard to see where you are today and what steps you can start to take to get your business where you want it.