Understanding the Financial Mechanics© of your business

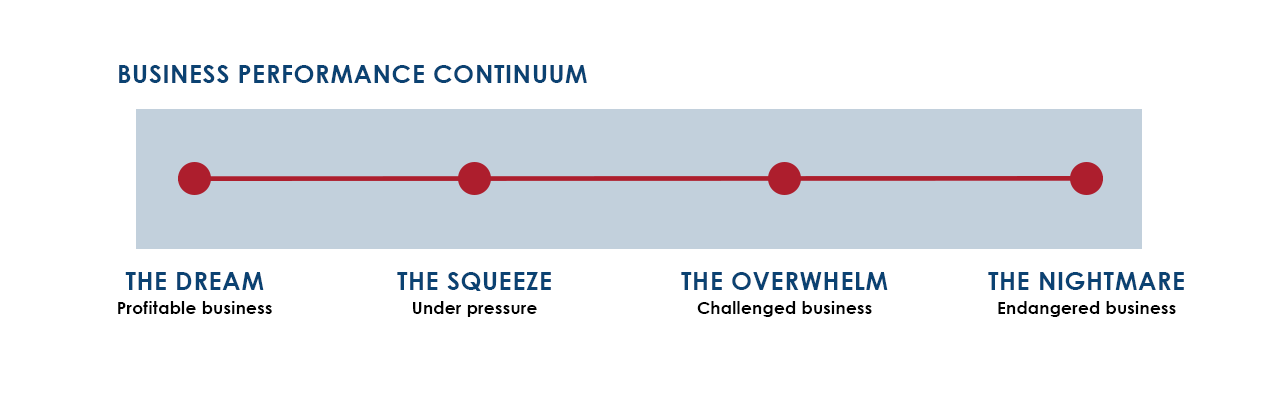

So far on the blog we’ve looked at why we're in business and how it’s going, all the different sorts of pressures that we have to manage as business owners and the spectrum that all businesses exist on; from the dream to the nightmare.

There are lots of reasons why your business could be at different points on that spectrum and also why it could quickly shift from one end to the other, sometimes it feels like in the same day! At the Business Growth Institute we help business owners understand all the different components of their business and how weak or strong they are in each of them, with our Business Diagnostic framework called The Rocket.©

Whilst there are many moving parts to a business, you can see highlighted in red on The Rocket©, the foundation for every business and what we always start with, is finance and cash generation and moving that to Firm Financial Foundations©.

The whole hypothesis here is that regardless of the problems you might have in your business and no matter where those problems exist, if you're not making money at the end of the month your runway is reducing and eventually there’s going to be a plane crash.

To make sure that doesn’t happen, we talk about the maturity of a businesses financial component and how the finance component of your business needs to be proportional to the size, scale or ambition of your business. By having a tight grip on your business’s finances it means you can create the financial foundations to generate the cash and the profit to sort out any issues across the rest of the rocket.

When it comes to the financial foundations of most businesses, the stats are really quite shocking. Industry research reveals:

- 30% of businesses are continually losing money

- 30% breaking even

- 40% are profitable

From my personal experience, of those 40% of profitable businesses I’d say half are reasonably profitable, while the other half are absolutely creaming it! That’s often more to do with niche than anything else. I’ve seen bad management in a great niche making serious money, and good management in a poor niche just surviving. A nice defensible niche below the radar is in my view a key determinant of serious profits for SME’s but that’s is a blog for another day, let us know if you'd like to read that by voting for it here and we’ll get writing.

A framework to understand how money flows through a business

So back to creating Firm Financial Foundations© in your business. When working with clients, we always start work by focussing on the finances first. Profit and cash flow solves a lot of problems. Once that’s sorted you have the stability and resources to fix any of the other problems in your business.

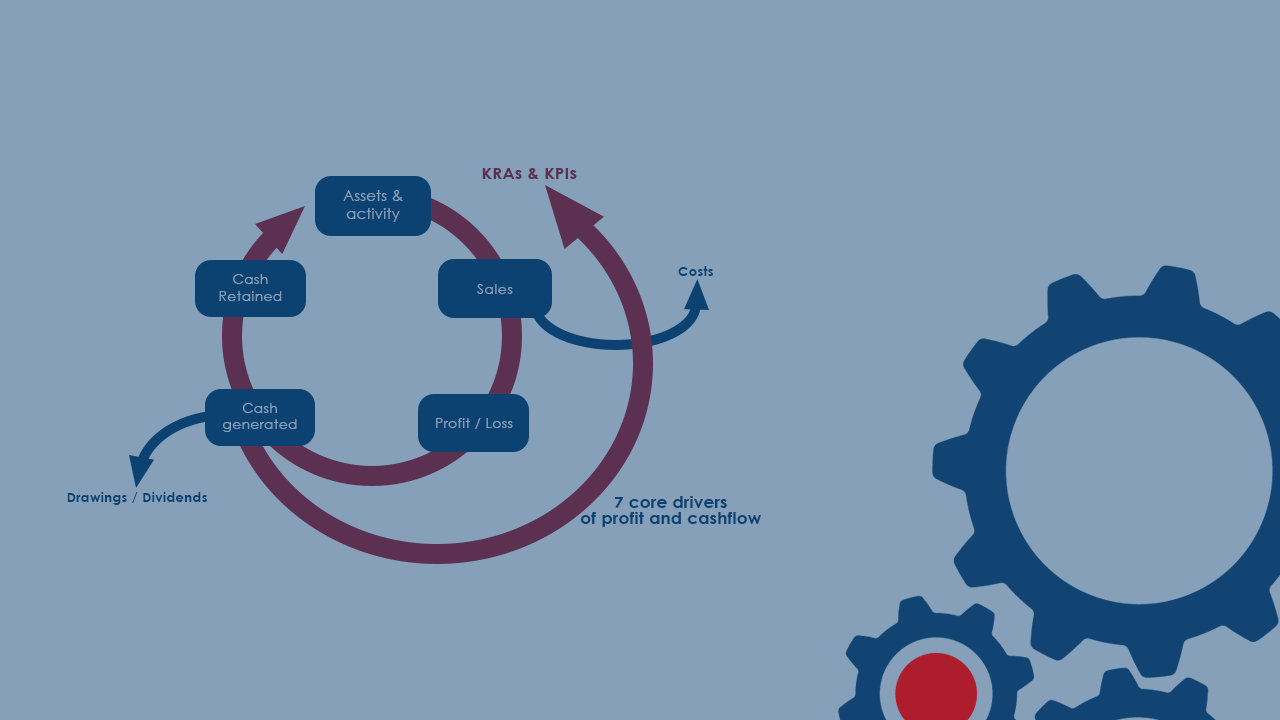

Before getting into the detail of gearing your business for profit, I want to start with establishing a framework of how money flows through a business, what we call The Financial Mechanics© of a business.

How money flows

1. Sales follow assets and activity

There are a number of elements, the first being that sales and income follow assets and activity. What do I mean by that, well of course sales and profits don't just appear, sales are driven by the assets your business owns or creates and activities of your team to sweat those assets.

For example, if you are generating profit from property and you've got one property the profit from that is going to be quite different to a portfolio with 10 properties. The more assets you have the more sales you should be generating. Assets are not just physical assets on your balance sheet, but also your activities and other assets like your brand, your market position, your team, your contracts, your customer relationships, intellectual property etc.

Now you say that, that sounds obvious, so why say it. I say it because the first thing you see in your accounts is the profit and loss. The first thing you see on your profit and loss is sales. There is usually no link in your accounts to show that income follows assets. The link between income and activity is there in the profit and loss, but it’s not as complete as it could be and is actually the wrong way round.

Sales are actually generated by activity (as well as assets) so to truly understand how you generate sales, you should be thinking about the activity and the costs of those first.

Okay, sales flow from assets and your activity. If you want to increase sales, grow your asset base and get smarter about the work your team does or get more of them. You may want to build people component in terms of headcount, skills or outsourced capability to generate more sales.

2. Profit (or losses) follow from sales less costs

The first thing that appears in the profit and loss is sales. But to make those sales, unfortunately we have to pay money out and that comes in two main categories;

- Your direct costs or the costs of sales

- Your overhead.

There’s a lot of misunderstanding and disagreement on whether to put costs in direct costs or overheads. You might think this is just a technical issue for accountancy nerds in a dark room. That could be a real mistake which is costing you thousands. How you analyse a business affects the decisions you make which in turn has a real world impact on the business’s ability to generate cash. If you get this wrong it can have a serious impact on the cash in your pocket.

Direct costs or overheads: A case study

Let me give you an example. Some years ago I was called in to help turnaround a £10m turnover social enterprise which had just made a £1.8m loss, the first in its history. The FD’s management accounts were not well structured and had mixed overhead in with direct costs of the different business units. He recommended stopping one part of the business which on paper was making a significant loss.

My analysis split up the costs between direct and overhead and showed that after direct costs the unit actually made a very significant contribution to that general overhead, costs which would remain even if the unit was closed. Had it been closed the losses would have increased not decreased.

That enterprise does fantastic work for the community. I am very proud to have worked with the Board to turn that business around which now generates EBITDA of £700-800k pa. Still not great but it’s working and still helping the community.

So how do you decide if something is a direct cost or an overhead? By way of example if you sell a widget then your direct costs include the costs of getting it to the customer, the material costs and any labour costs to make that widget. These are all direct costs.

Your overheads are the costs of running your business as a whole. The cost of running an office, insurance, lots of things like that. Generally you will incur those costs whether you sell one widget or you sell 100 widgets in a particular month.

The income from your sales less your costs then equals your profit or your loss.

So now we know:

- Sales follow assets and activities

- Profit is sales less costs

3. Operating cash flow follows profit/(loss) but with a different (usually delayed) timescale

If you've been in business for even just a short while you'll know that profit or loss doesn't actually turn to cash straight away (unless you have a very simple cash business). In general terms it takes time for the profit or loss in a business to show up in cash.

There are 3 basic cash flow drivers that again we'll look at, at some stage, to speed up how quickly profit turns to cash. Obviously the faster you get your profit into cash, the better. So:

- Sales follow assets and activities

- Profit is sales less costs (direct and overhead)

- Operating cashflow is generated by profit (or loss) but with a different (usually delayed) timescale

4. Cash retained follows from cash generated less cash taken out of the business

Of course the profit that eventually flows through to cash can then be retained in the business, or it can be paid out in drawings or dividends to the owners of the company. If cash goes out of the business that's going to reduce the cash retained and net assets and the ability of the company to invest in the assets or activity needed to grow more sales and make more profits and generate more cash.

What you take out of the business as an owner will depend a lot on the maturity of the business and what you're trying to achieve. Are you running it for cash because perhaps you want to retire soon and you're building up your pension pot? Or are you running it to build for value to sell to somebody else in X number of years? Let me know if you want to hear more about that and we'll get writing.

The decision about how much money you extract from the business and how much you retain influences your ability to build the assets and generate more activity, sales, profit and cash. The more sales you can generate from your assets and activities the better. The more efficiently you can convert your sales into a profit by minimising your costs the better. The faster you can get your profit into cash the better because you can either take more money out more quickly or you can keep more money in the business to buy more assets and do more activity.

Understanding how effectively money flows through your business

Having established the framework of how money flows through the business, I’m going to introduce some ratios that will show you how efficient this circular flow is in your business. If you understand what drives those ratios and how to improve them, you’ll have way more money in your business or your pocket and your business will increase in value.

I’ve established the framework first, as the accounting behind this can get a bit complicated for those of you not lucky enough in life to be an accountant. If you get lost in the numbers, go back to the framework above as your reference point. I’m hoping that, if you’re not already familiar with these things, you’ll be getting a much stronger grasp on The Financial Mechanics© of your business.

What is an asset and how does it generate sales?

The first thing, without getting too much into accounting, is understanding the balance sheet of your business. In essence it is your assets less your liabilities and that equals your net assets or your equity.

The example I often use is that of a property. Most people will identify with property and that if you have a property worth £200,000 and on that property you've got a mortgage of £70,000, then:

- What you have - Your asset (the house) is £200,000

- What you owe - Your liability (the mortgage) is £70,000

- What you own - Your equity or net assets is your asset of £200,000 minus your liability of £70,000 which equals your net assets, or equity, of £130,000

So let’s say you've got one property with a mortgage and net assets of £130,000, with that single property you'll be able to generate rental income, but from that rental income you've got to service the mortgage. Your liabilities generate costs that have to be paid for out of the income generated.

Remember, sales follow assets so the more assets you have, as long as you're being efficient about it, the more sales you should be able to generate. If you've got one property you might make a certain amount of profit per year and if you do that for a few years and retain that cash in the business then you might be able to buy another two houses. This is just an example, but let’s say the two houses you bought were also £200,000 each, you've now got £600,000 worth of assets. You might have more liabilities because each property has got a mortgage on it, but your net assets have increased and therefore that business is worth more and can generate more sales, profits, etc.

That's how you understand the opening position of both your assets and your activity and how, if you've got more assets, that puts more into the businesses financial system of sales, profits, and cash. To fine tune any business you need to understand this core concept.

Some key high level operating ratios

Okay, having set the foundation for understanding, let’s look at some key operating ratios which will help you as an owner, see how effective your business is at generating profit and cash, and the areas you might want to focus on to improve that.

Asset effectiveness

How well do you work or sweat your assets to generate sales.

So now we are hopefully clear what an asset is, you've then got to understand the rate at which you are taking those assets and converting those assets into sales. If you've got a certain amount of assets and you can double the sales from those assets your percentage asset effectiveness improves and it puts more profit and cash into that circular flow and more can be taken out or invested in the business.

The Asset Effectiveness ratio gives an indication of how effective you are at using your assets. Understanding and improving the number will drive more profit and cash through your business.

Operational efficiency

The next bit of the framework to analyse, are your profits. How well do you convert your sales into profits? If your net profit is £10,000 and your sales were £100,000 then your operational efficiency is 10%, you've got a 10% net profit margin.

If you can increase that to 20% your business is going to be worth more and you can have more money to grow the business or put into your pocket. Managing the profit and loss is a subject for another day but for a given level of sales it’s all about an effective spend on direct cost and overheads and the activity that generates.

The Operational Efficiency ratio measures the effectiveness with which you do that.

Understanding and improving this number will again drive more profit and cash through your business to grow it or for you to take out as a reward for having an increasingly profitable business.

Cash productivity

Your cash productivity in any period shows how quickly your profits generate operating cash flow. Your profits might be £10k pm but because you're not going to collect your cash from your customers for two months, and you have to pay your suppliers in one month, your cash productivity may actually be negative. You’ll need more money or working capital in the business to finance that profitability.

You got it, understanding and improving this number will again drive more cash through your business to grow it or for you to take out as a reward for having an increasingly profitable business.

In conclusion

Understanding The Financial Mechanics©, how money flows through your business, are essential to knowing how to generate more profit and cash on a consistent basis. In the same way that a car dashboard shows you when you’re running out of petrol, the operating ratios will highlight to you which parts of the business are functioning well and what aren’t. You’ll have a far better idea of where you can push and pull, and focus effort and spend to squeeze the ratios and get a more efficient business.

The ratios are however high level. In my next blog we’re going to drill down further into what we call the Seven Core Drivers Of Profit And Cash Flow In Any Business©.

If you’re on this journey with your own business and you want to improve your profitability and cash flow, then take our Free Profit and Cashflow Scorecard. That will help you start to audit where you are at the moment and give you the starting place to apply our frameworks and tools to see how you might improve the profitability of your business and get a lot more out of it.

To your success

Shaun

Ready to start planning for profit?

Complete our free Profit and Cashflow Scorecard to see where you are today and what steps you can start to take to get your business where you want it.