What does a mature finance component look like?

In a recent blog we looked at the foundational component of any business, Finance and what the finance component looks like at different stages of maturity; from the brown paper bag, to spreadsheets, double entry software, right through to forecasting, and strategic FD level foresight.

The maturity of your financial component should track proportionally the scale of your business or if you want to grow, the scale of your ambition. It is only from these Firm Financial Foundations© that you can begin to build, develop and improve the other components of your business.

Remember, in that earlier blog, I also talked about the factors in a business which might contribute to your business’s financial function needing to move up the maturity ladder; transaction volume, how quickly you're growing, larger contracts, changing payment terms etc.

In this blog, I want to talk about what a mature financial component actually looks like and really unpack how your accounts get built up and how they should inform operations within your business.

Here's what I'm going to step through:

- What is your latest financial position? - Management Accounts

- What results are you planning to achieve? Budgets and Forecasts

- How do Management Accounts get built up?

- Controls, systems and management

- Financial Mechanics: Bridging the gap between results and targets

- The Seven Core Drivers Of Profit And Cash Flow©

- The core of any finance component

- Analysing your accounts and strategic planning

- That seems like a lot of work. Who does all of this?

- The summary

- In conclusion

So let’s take a look at how a mature financial component should be structured and work.

1. What is your latest financial position? - Management Accounts

The first part is understanding the results and the scorecard of how your business has been doing in recent times.

Good financial reporting which informs sound decision making will include:

- A profit and loss (P/L) by month, perhaps with some graphs to show you what's happening in that profitability

- A variance report of your budgeted results compared to your actual results

- A balance sheet (B/S) with some ratios

- A schedule of aged debtors - to show you who owes you how much money. This should be aged over 30,60, 90+ days to who you how efficient you are at collecting cash

- A schedule of aged creditors - to show you who you the trade creditors you owe how much money. This should again be aged to see if any debts are overdue

- A cash flow report or source and application of funds - there are generally two types of cash flow report format

You’d also want some KPI (Key Performance Indicator) dashboards with key numbers and ratios. These might include:

- High level numbers - eg sales, cash

- P/L ratios as a percentage of sales like - gross margin, overheads and net profit %’s

- B/S ratios - the current ratio, return on capital employed, debtor and creditor days etc

- Other performance data eg net promoter score, staff turnover etc

I won't go into all these here. We’ll define this further in future blogs. Suffice to say for now KPI’s and ratios are very powerful gauges of what’s working well in your business and what needs attention.

2. What results are you planning to achieve? Budgets and Forecasts

Once you’ve got a grip of where you are, you then need to plan for the future.

You need some ability to target what profit and cash you want to generate and then model the different options of how you might achieve that. Once you decide on the plan that then needs to be spun out over 12m which becomes your budget. As you go through the year and see where you’ve got to, you might then use a forecast to give you the latest view of where you are going to end up.

Your management accounts and your budget then enable your accountant to report the variances of what you hoped to have achieved this month and year to date with what you have actually achieved. Once you have robust variance reports in your monthly reporting cycle you are starting to get real control over the financial performance of your business. Where you’re on and off target and areas for attention.

So those are the two basic pillars of the finance component. You should be getting management accounts from your accountant preferably on a monthly basis or for simpler businesses at least quarterly.

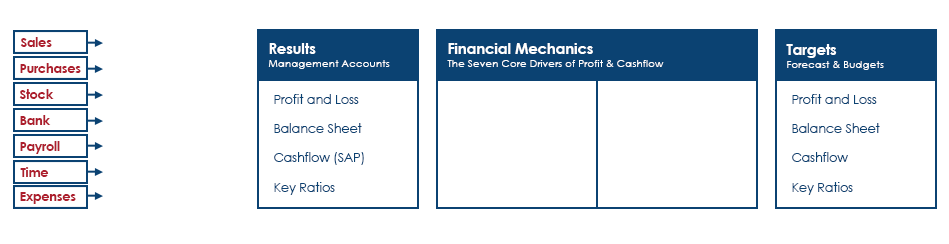

3. How do Management Accounts get built up?

So far so good and all of this probably makes sense at a conceptual level, however whilst business owners do not need to be accountants, it is helpful if they have a basic understanding of how management accounts get built up.

So let’s start with results.

All activities in a business eventually lead to a financial transaction.

It might be selling something, buying something, doing something which has a payroll cost at the end of the month, getting a customer payment into the bank etc.

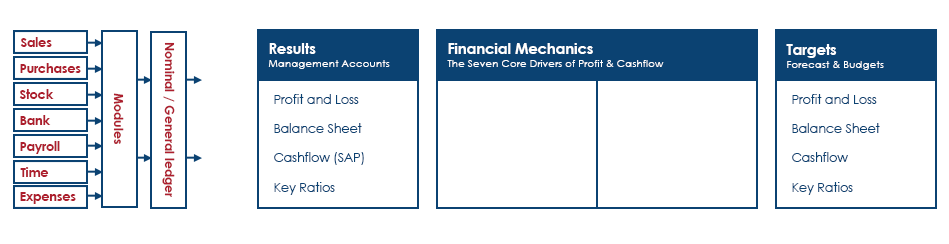

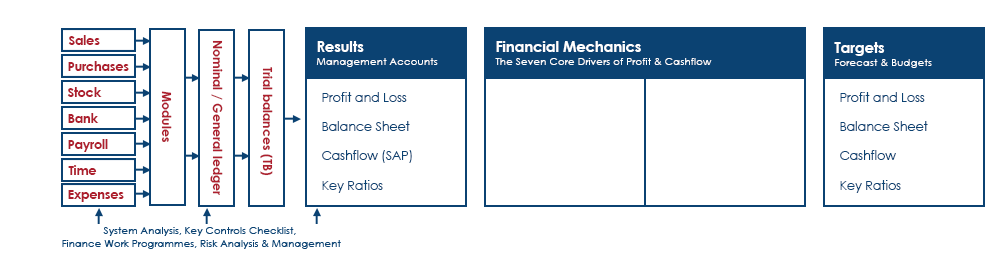

All of these transactions eventually get reflected in one of the modules of your accounting system.

Transactions may be recorded in your double entry accounting system such as Xero, Sage or QuickBooks etc. Some transactions get recorded outside of the accounts and have to be journaled in at the end of the month. Stock for example, is something that isn't always incorporated in the accounts software. To be accurate and of use, your management accounts need to reflect all of those transactions.

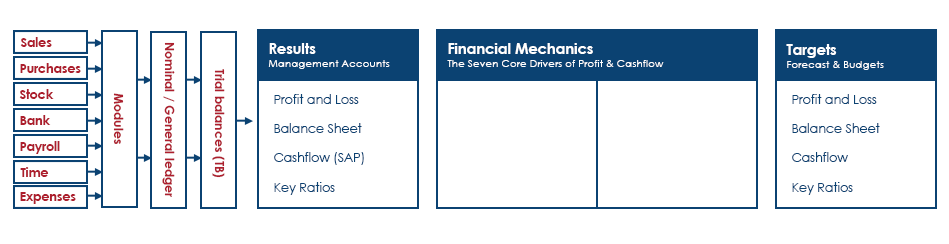

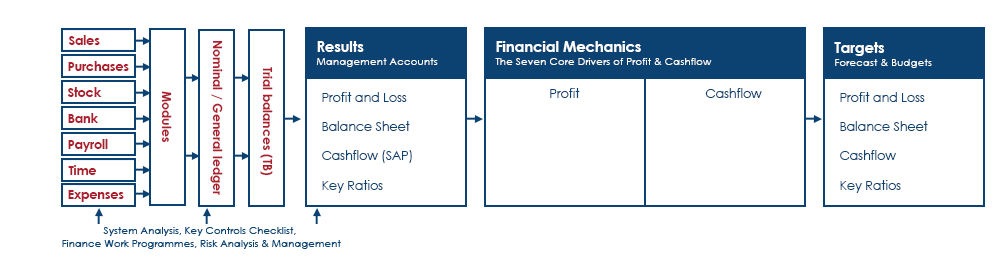

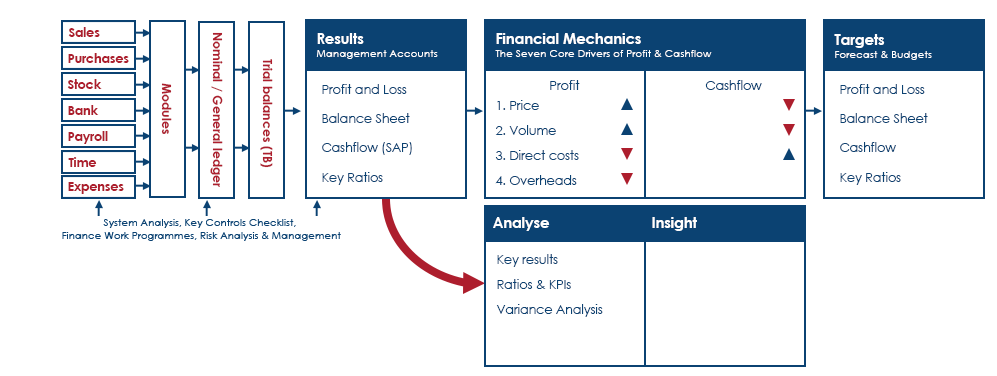

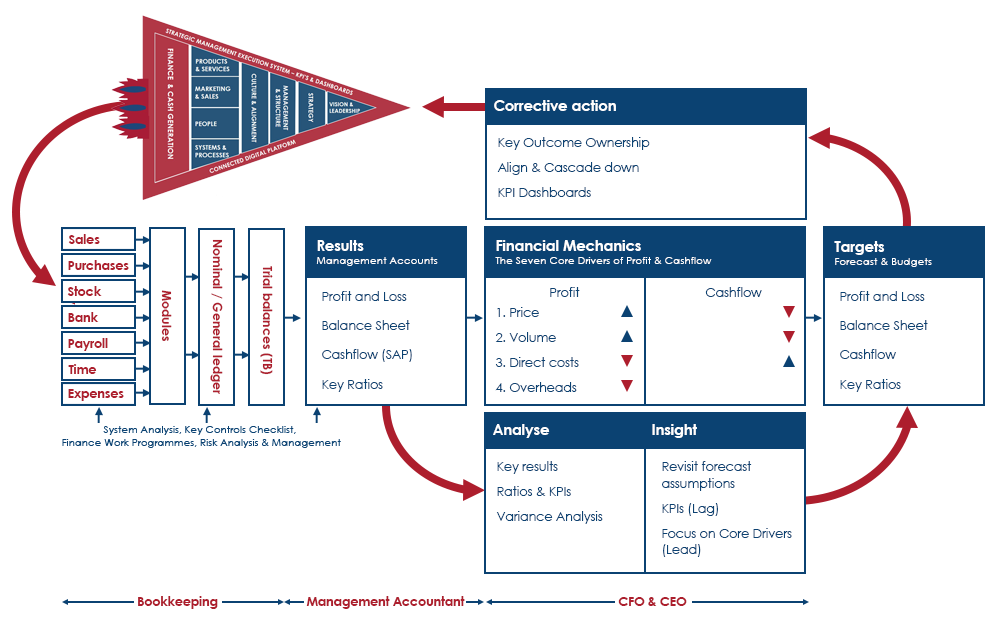

These different streams of transactions get entered into the modules in your accounting software noted in the left hand column above. Your software then records these entries into what you may have heard your accountant talking about as the nominal ledger or the general ledger.

The balances of those different nominal accounts comprise the trial balance which is split into either profit and loss or balance sheet accounts.

It is from that trial balance that your profit and loss and balance sheet actually gets produced in the form of monthly management accounts or year end published accounts.

Pretty clever eh? It is a little known fact that double entry, the basis of all this, was first published by an Italian mathematician Luca Pacioli in the 14th century. That may sound a little nerdish. The fact is however, that double entry is one of the key building blocks of modern day organisations, without which we would not have the goods and services on which we all rely. Luca is the man!

4. Controls, systems and management

People think if you’ve got Xero or some other inferior system, your accounts are sorted. That's rubbish...literally. If you put garbage in, you get garbage out!

The robots are coming but they’re not here yet,....in accounting at least. Accounting software does what you tell it to. There are a lot of processes, integrations and controls that need to happen around your accounting software to make sure the information in the accounts is good reliable information upon which you can make serious decisions.

These include:

- Design of the process so you know where information is entered and taken from for the accounts

- Consistent and accurate input of that data into the right part of the accounts software. Training will no doubt be required for this

- Information then needs to be properly controlled and regularly checked and reconciled to make sure errors are rectified quickly

- Reports then need to be produced on a timely basis with analysis and insight to inform management so good decisions are made at the right time.

The items beneath the processes that happen to build up your management accounts; systems analysis, key controls checklist, finance work programmes, risk analysis and management are things that we'll return to in more detail in later blogs and videos but you need to have rigorous controls, processes and systems in place to make sure the information you’re using to make decisions about your business are correct.

5. Financial Mechanics: Bridging the gap between results and targets

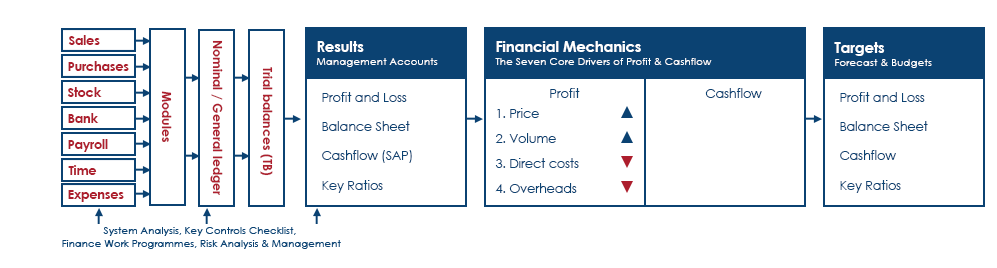

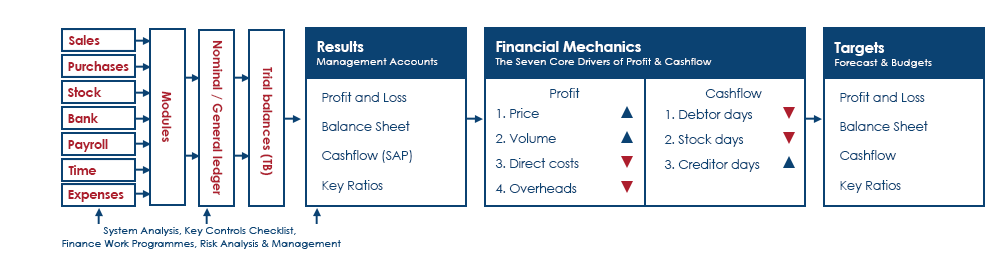

How we take the vital step from regular financial management accounts that track what’s happened historically to predicting and proactively adjusting strategy and activity to deliver financial targets is via what we call The Financial Mechanics© of a business.

How we optimise and improve those financial mechanics over time is via what we call The Seven Core Drivers Of Profit and Cash flow©.

I promise you one of the best ways your can stack the dice in your business is to double down on these Seven Core Drivers© in your business.

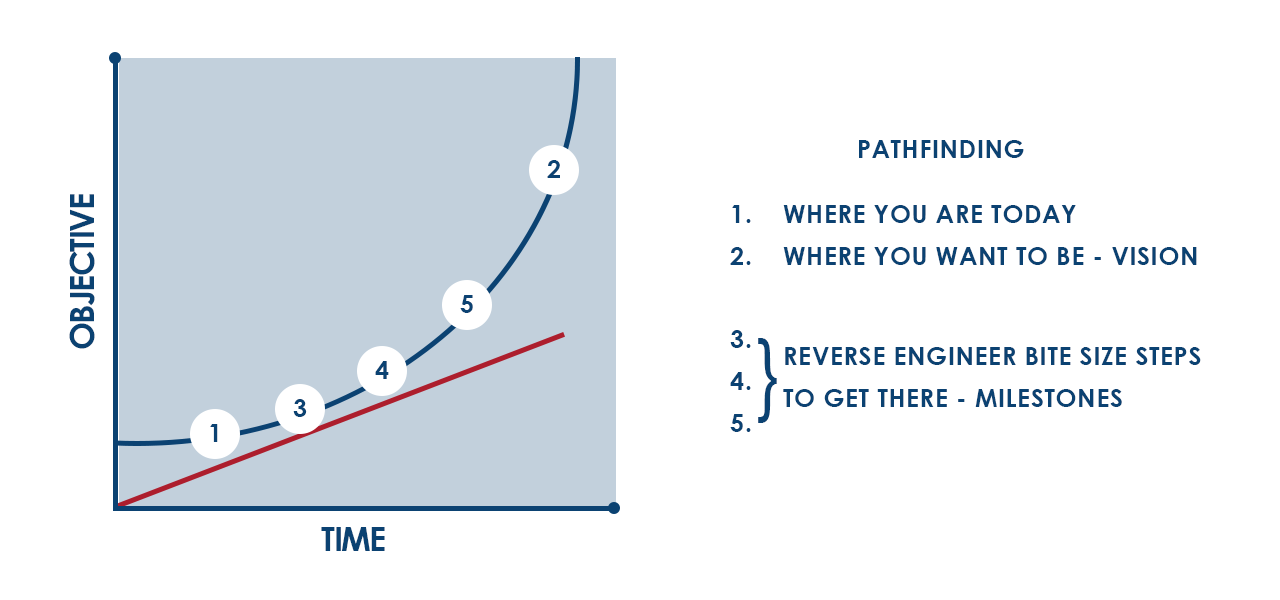

The basis of this model goes back to another topic we covered in an earlier blog called Pathfinding. Rather than planning how much profit you want to make next year based on small changes from the last, what we recommend is to look at the target profit you want to make first then reverse engineer activity in the business to make that happen.

When we work with clients we always start by looking at the medium term horizon, what the business owner wants to achieve in say 3 years then reverse engineer from there. It often means that we have an aggressive profit target for each year that needs firstly a strong focus on Firm Financial Foundations© and then strategic and consistent operational management to cascade the goal through the business into activity and deliverables that make it happen.

We've developed a programme to help you do this that we call The Double Your Profit Programme©. We created this programme to help business owners apply the financial management and pathfinding approach we advocate as well as how they can drive the necessary actions to double their profits in 12 months... or less!

We know not everyone is quite ready to jump into a full guided course with the Business Growth Institute so to help you dip your toe into our approach, how we think and how it could apply to your business take our Free Profit and Cashflow Scorecard© to get an overview of your businesses profit and cashflow position today, then we’ll also send you our free Profit Calculator tool. You can use this to start adding in your own profit target numbers and tweak some of the drivers of profit to see what needs to be true in your business to make that a reality.

With this model, we’re saying that profit is not an end result of activity. In our business what we want is profit to be a core planning objective around which we organise the rest of the business.

I think even Luca the Great would be impressed by that.

6. The Seven Core Drivers Of Profit And Cashflow©

To work out what needs to be true in the next 12 months in order for you to reach your 3 year profit target you need to focus on the Seven Core Drivers Of Profit And Cashflow© . In my last blog I covered The Financial Mechanics© of a business, how money flows from assets to sales, to profit and ultimately to cash. This core concept is an important foundation to truly understand The Seven Core Drivers Of Profit And Cashflow©.

Having set your Double Your Profit goal for the next 12 months, these Seven Core Drivers show you what you can push and pull and by how much to hit your profit target.

The four drivers of profit

To improve the profitability of any business there are four levers at your disposal:

- Increase your sales price

- Increase your sales volume

- Reduce your direct costs

- Reduce your overheads

That’s it.

There’s nothing else…..in any business. It’s very simple….but it sure ain’t easy!

There are multiple ways of tweaking these drivers in as many combinations as there are businesses. At the highest level however these are all you need to focus on.

Increasing your prices is the fastest way to increase profitability but this is often something business owners won’t have considered, usually out of fear their clients won’t like it and will take their business elsewhere. There is however risk in doing this and a whole subject area of how best to do it, by how much and how often.

You’d think it goes without saying regarding volume, that if you can sell more, you’ll generate more profit, but that's not necessarily true! It all depends on how profitable those sales actually are before you start trying to ramp up volume. This is what accountants call gross margin, one of the most important numbers in your business. A key part of my role and what I love doing is to educate and train business owners to understand their numbers better than they do.

There be gold in them there numbers!

Business financial literacy doesn’t get taught at school. It should be. Developing that training is one of the next things on my development list. If you’d be interested to get that training when it’s ready let me know by registering here and you’ll go on the distribution list when it’s ready.

So back to sales volume, if you start ramping up volume for a load of products with thin margins or that take a long time to turn into cash, that can be a recipe for disaster.

If you can reduce your direct costs, which is the cost of delivering those sales, then again you are increasing your margin on every sale. If you can increase price and decrease your direct costs or you can do things more efficiently, that is all going increase your gross margin.

The fourth driver in the profit and loss is your overhead. What can you do to decrease the general costs of running your business?

At first pass most business owners think they are on top of their costs and run a tight ship. We have a number of exercises that we do with clients to push that thinking a lot harder than might normally be the case. One useful thing you can do yourself is to look at your average P/L over the last say 12m, reduce your sales by 20% and then see what costs you’d cut first to balance the books. Do that and you’ll probably find the soft spots where you could actually cut costs now. All of those savings will drop straight to the bottom line and go into your pocket rather than someone else’s.

The three drivers of cashflow

You’ll remember from my blog on The Financial Mechanics© that making sales and generating profit is great, but how quickly you convert profit (or loss!) into cash is critical. The three levers you can pull to improve cash flow are:

- Reduce debtor days (Get paid by customers more quickly)

- Reduce stock days (Get your goods or services from the start of the process to the delivery and sale/invoice more quickly)

- Increase creditor days (Pay your bills later)

If you can reduce your debtor days and collect cash faster, your cash at bank increases and you need less working capital to finance your business… let alone being able to sleep better at night.

If you can reduce the number of days it takes for stock to be despatched and invoiced or days that services are work in progress, then you can have less cash tied up on your balance sheet in working capital and more cash to drive or de-risk the business or even more cash you can take out.

The driver you have the most direct control over is delaying payment to your suppliers. Whilst you’d like to delay payment and have your suppliers finance your business, this is something to be sensible with, otherwise your suppliers will up and leave. You don't want to cannibalise your supply chain.

So those are your three cash flow drivers. If you improve profit that will also improve your cash flow. The reverse however is not the same. Cash flow drivers improve cash flow, but don’t directly affect profit (other than in less direct ways such as interest payments etc).

Look out for my next blog in where I unpack The Seven Core Drivers Of Profit and Cash flow© some more.

7. The core of any finance component

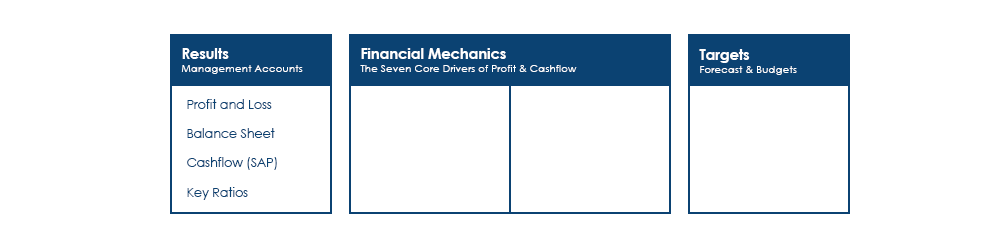

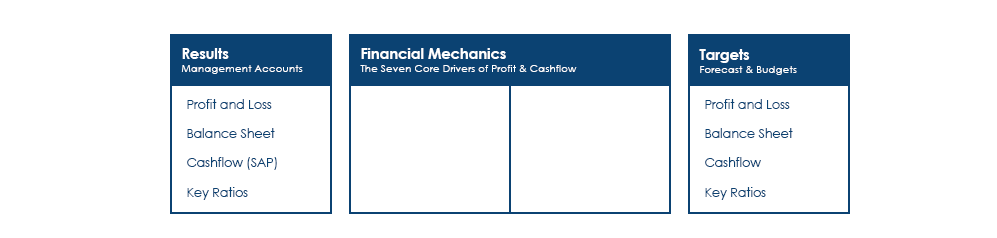

For any mature finance component then there has to be three things at its core:.

- You've got to be reporting results, at least on a quarterly basis, but preferably on a monthly basis so you know the score.

- You need to have a way of targeting, forecasting and budgeting for a specific profit number in the next 1 to 3 years.

- You then need to know what, when and how to adjust, tweak and iterate each of the The Seven Core Drivers Of Profit and Cash flow© to achieve your goals.

Use those three core elements as a business owner or management team to challenge your thinking and to reverse engineer the business around making the profit that you want.

If you think you might need some help with that, The Business Growth Institute has a tried and trusted process and a detailed report to help you do exactly this sort of planning. We call it The Financial Mechanics Report©.

What we do in this process is:

- Conduct a high level diagnostic of the financial results of the business over the last 2-4 years. This is done by qualified finance professionals

- Based on the specifics of your business we send you a personalised 17 page report, drilling down into the key Financial Mechanics© of your business. The key numbers and ratios which drive your business. These are the nuts and bolts of how your business generates profit and cash presented in a highly visual format which is easy for non accountants to understand. This report will also show you how small changes in any one of The Seven Core Drivers© will move the dial on your profit and cash flow. It also includes an indicative value of your business and how changes in the drivers will in turn grow your business value

- You'll then have a meeting with me (Shaun) to take you through the report and then together we'll double down on The Seven Core Drivers©. We’ll discuss how far each driver might be improved and see the impact on profit, cash flow and business value. Our goal in the meeting is to come up with a model to Double Your Profit In 12 Months…Or Less!©

- You can use that to develop a financial and business plan for the next 12 months that you and your management team can deliver. (We can also help you build that plan if you don’t have internal expertise to do that)

The impact of this report and process can be profound and have a major impact both on the business and what it’s owners get out of it in terms of cash, time and ease of operation.

We’re very happy to help people learn who want to do it themselves but this is also our starting point for those who need more hands on help to make this happen via our Double Your Profit Programme©.

8. Analysing your accounts and strategic planning

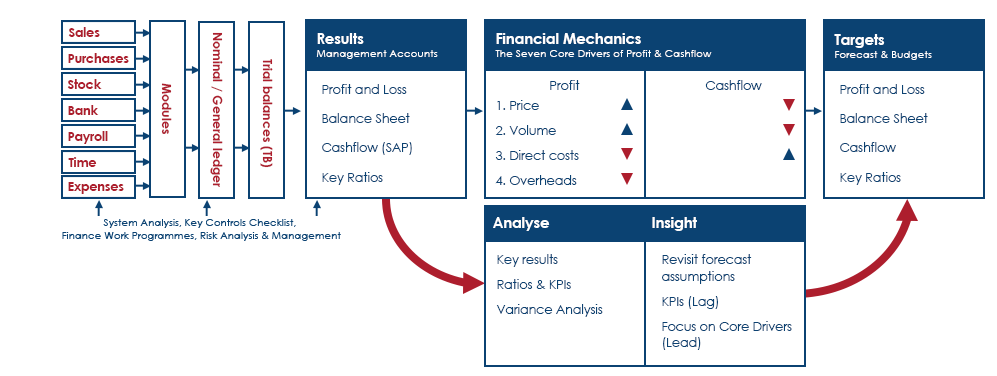

So those are Seven Core Drivers Of Profit and Cashflow© but we need some wrap around processes to make sure decisions we make about changing those are accurate, timely and proportionate.

Firstly, you’ll want to look at your monthly management accounts to understand your results and what’s going on in the business. Over time you’ll learn to read these quickly and can skim the key numbers, ratios and KPIs and the variance analysis telling you if you are ahead or behind budget.

I reviewed a set of client management accounts done by one of my management accountants yesterday in less than 5 minutes. I was able to do this because our management accounts process is a well oiled machine, I know the business inside out, the client has diligently implemented my process and advice over the last several years and so the accounts are as clean as a whistle. Also the business is highly profitable with a 35% net profit margin! We are by no means responsible for all of this but I’d like to think our advice and support has accounted for 10-15% of that. One of the reasons we are starting to move to value based pricing!

By the way, just to be clear this is not at all always the case. When we first take over a client it can take me a day to wade through the treacle and sort out the issues.

Okay. Back to the budget. Once you have a formal 12 monthly budget in your accounts software you should be able to compare your actual results against the budget for that month and the year to date. This will give you insight as to what's going on with the health of the business and changes you may need to make.

This analysis then leads to insight. You might revisit assumptions, you might look at what's going on with the KPIs and start to think about what's going to drive those KPIs, what are the lead drivers that are going to determine the lag KPIs?

When you think about what’s going on there will always be new information and things happening which, if significant you may want to feed into a revised forecast. This will be particularly important if you’re tight on cash flow.

What’s the difference between a budget and forecast? Good question. Normally a budget is the plan for the year and that stays the same but the forecast is what you think is going to happen based on your latest understanding of things. A forecast is much more of a moving target and is updated periodically, every 6, 3 or 1 month. The higher the variability and risk the more frequently you’ll need a forecast to be updated. If cash is really tight, one version of this is a 13 week rolling cash flow forecast which is updated weekly. If dire then that may need to be daily.

Your forecast then shows what you think the results will be at the end of your financial period based on your current knowledge.

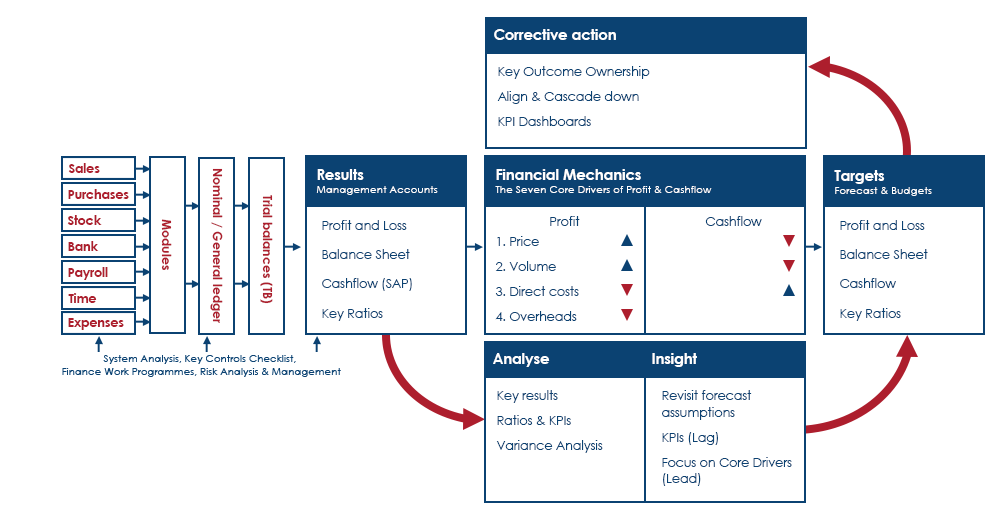

All of this then informs your corrective action.

What's going on in the business? What needs changing? Who’s going to do it? What outcomes do we want people to take ownership of and by when?

We have some powerful ways and tools to help you manage these changes or corrections down through the business and we call this part of our process Get A Grip Of Your Business©.

To do this you want to have a series of aligned dashboards and key result areas which cascade down through the business so that the whole business is aligned around the corporate budget and the objectives. The dashboards can be RAG rated (red, amber, green) so you can quickly zero in on what needs attention and leave the rest so you can work on the business.

Whatever corrective actions are decided upon as a result of the financial insight, they then need to be driven down into the business and to the different functions or components of the business.

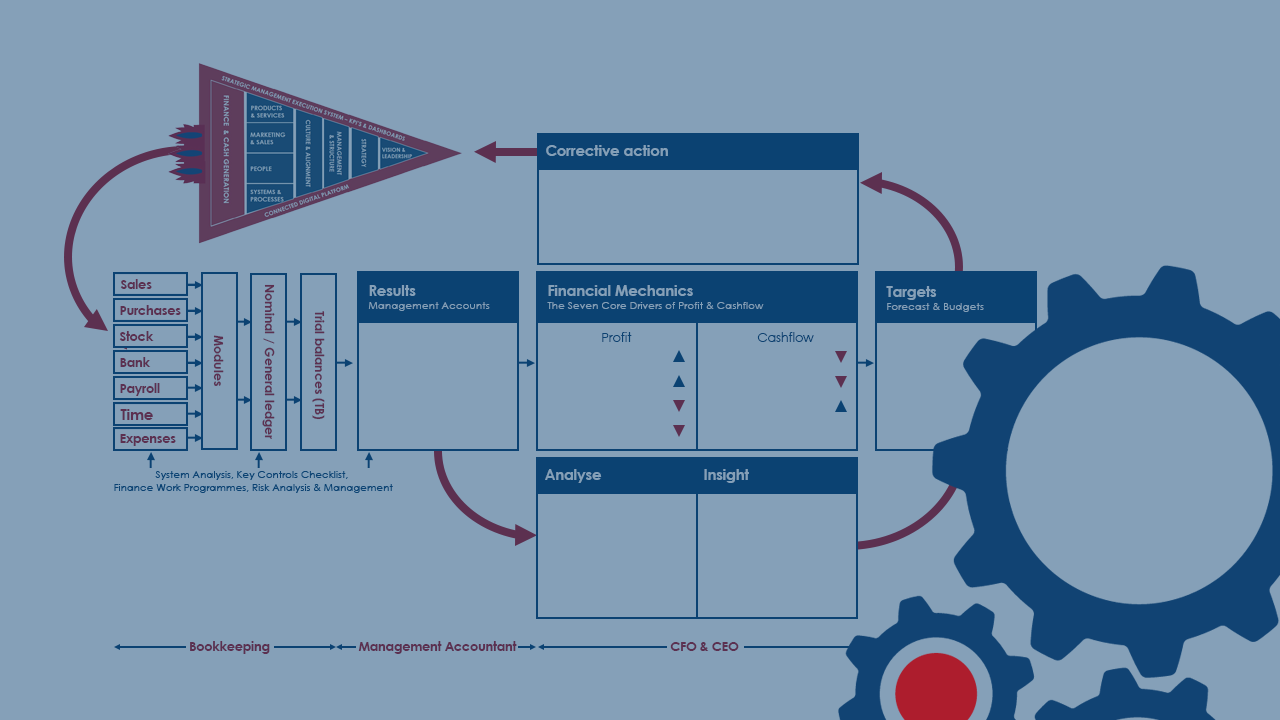

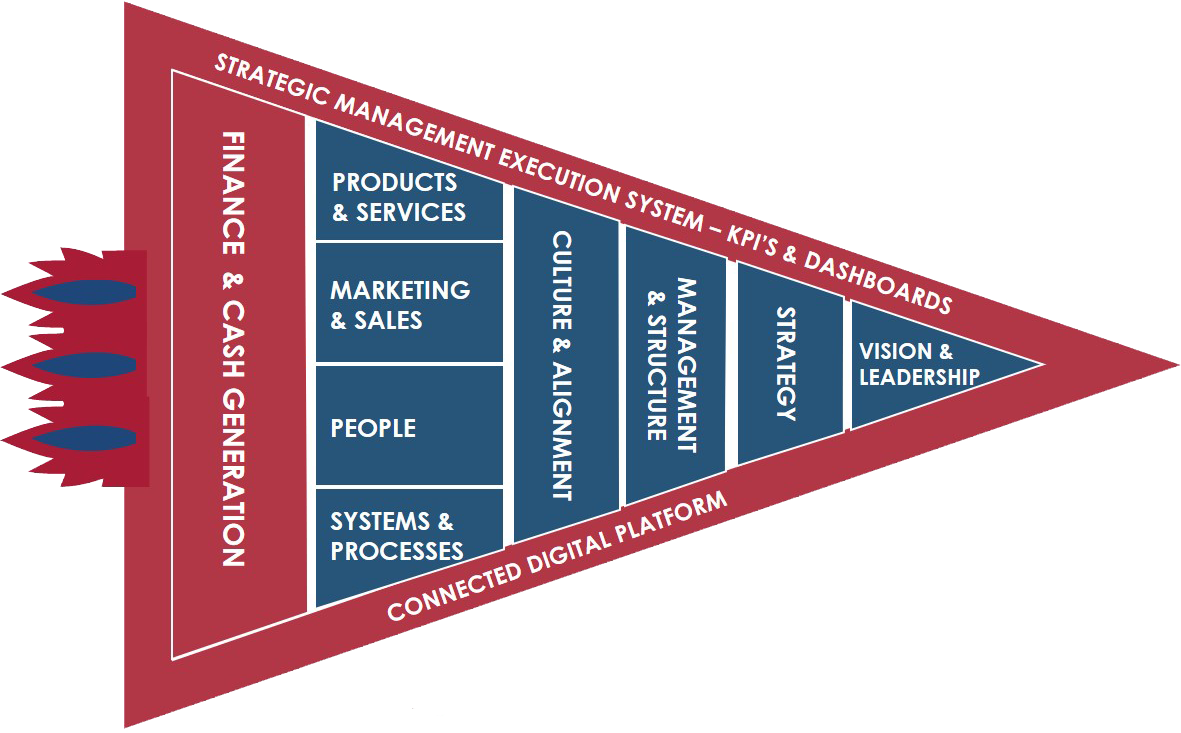

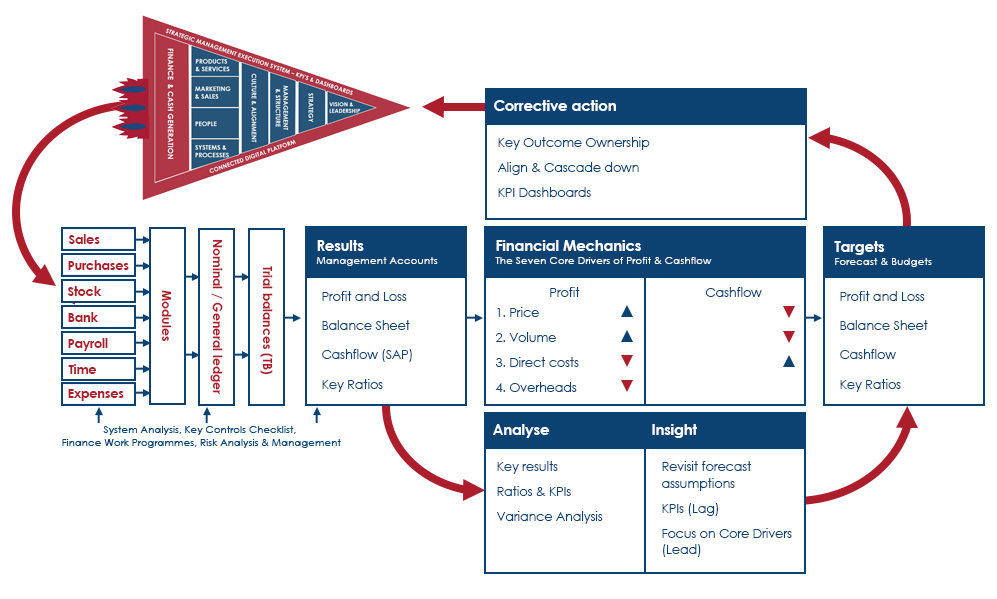

We capture the wider business components in our diagnostic framework the Rocket© but whether its the services or the products you deliver, the finance department, how you're managing people, marketing and sales or operations, critically, feedback from the financial insight and the consequent corrective actions, need not to just sit on a report that nobody sees, but be driven by the leadership team throughout the business.

These corrective actions then hopefully move the dial on the Seven Core Drivers Of Profit And Cashflow© which in turn generates the cash to fund the next cycle and the transactions which are then recorded in the different accounts modules and it all starts again. It goes through the accounts software and shows up in the management accounts and hopefully you're back on budget or preferably better.

I’m tempted to call it “The Circle of Life”. Life it’s not. The lifeblood of a business it certainly is.

Get that lot working and you’re on your way to a seriously well controlled and profitable business which is then a firm platform ready to safely scale.

How we run this with clients and help them to Get A Grip Of Their Business© is:

- A monthly board or finance meeting to review the dashboards, results and consider actions needed

- This is then recorded in some management accountability software with clear ownership, accountability and alignment so there's nowhere to hide

- This activity and the relevant KPI’s are then split out to the core marketing, sales, operation and finance teams who meet weekly to execute the plan

- Actions taken are again fed back into the monthly board meeting

Interestingly, on dashboards and very clear ownership of outcomes etc, we find high performers or A players love this sort of high accountability environment. It’s the B and C players who don't like it. They start to see the writing on the wall, self select and go off and find work elsewhere. You then have the opportunity to go and look for more A players who are more suited to the high performance management process that you're bringing into the business.

9. That seems like a lot of work. Who does all of this?

You might be looking at this image and thinking, “Wow that looks like a lot of work! Who’s going to do all of this?”

The reality is that it’s the whole business who are involved in making this happen, you’re just aligning them around a monthly reporting and financial business cadence.

At its most basic level it might be that you look at a P/L, see a cost you don’t like and cancel a subscription. It's the same process on a basic scale. Make the process applicable to your size of business, but the more profit and scale you want, the more deliberate you’ll need to be about it.

As a business grows the functional accounting roles will need to be better understood, structured and resourced. I explain these roles more below but I’ve seen businesses where roles and expectations are confused or misaligned with disastrous results, here are a few examples:

- Bookkeepers who file year end tax returns making mistakes which have cost £10s of thousands

- Accountants and FD’s who have defrauded companies, sometimes over years, without the business owner having any idea until it was too late

- FD’s making more complex tax decisions. I am always very clear with clients I am a Strategic Finance Director and help turnaround, build, buy and exit businesses. I do not do tax. I may be a former PWC Chartered Accountant but asking me to give tax advice is like asking a GP to do brain surgery. They may both be doctors but there the similarity ends

- I’ve also seen tax accountants dabble in business growth advice with at least one client losing their business and livelihood as a result

If you understand who can and should do what, you’re far less likely to make mistakes so here’s a few pointers.

Bookkeepers / management accountants

Data entry may be done by different people in different departments, particularly if you've got cloud based accounting software like Xero where they don’t all need to be in the same area or function.

For example sales and operations might be doing the sales invoicing. The accounts department might be doing the purchases, the bank, the payroll etc. This is essentially your bookkeeping function. It’s the responsibility of different people in different areas of the business to get the information out of your various operational systems and into the accounts.

Remember, you’ll also have the systems analysis and key controls in place to sort through that so the data is accurate, correct and delivered on a consistent monthly basis for the month end.

Normally the production of month end accounts needs higher level finance skills, those of a management accountant. Management accounting may be done internally but if only a few days a month perhaps externally. It all depends on the nature and size of your business.

Chief Financial Officer / Finance Director

The modelling and the profit management and strategic side of the business needs higher level skills again, more CFO or FD skills. I always think for a more substantial company, the most important relationship on the board is the CFO and the CEO, or the FD and the Managing Director.

Generally the Managing Director or CEO is the one leading out with vision and strategy and getting all the departments focused on the key outcomes and dealing with issues. The FD then controls the bottom line and cash flow and feeds the insights from the forecast and the budgets into the CEO and the senior management team so everybody is aware of the financial backdrop when they’re making business decisions.

The CEO/CFO or MD/FD relationship needs to be very strong and aligned or there can be a real chasm in the senior management team and from them the business as a whole.

10. The summary

Hopefully by stepping through this you can see that it’s a very logical flow of data, analysis and insight that helps a business owner or management team really focus in on the areas and issues that are going to drive profitability and cashflow.

I’ll go back to the three core elements I outlined earlier for a mature and successful financial component:

- You need to have some sort of management accounts that give you feedback on how you've done in the last quarter or the last month.

- You need to have forecasts and budgets and a profit target for the year which should all be oriented towards your 3 year profit target.

- You then have a whole area of thinking between the actuals and your forecasts about the financial mechanics of the business and how you are going to optimise the seven core drivers of profit and cashflow to hit your target profit number.

Once you have got those three pillars in place, then it becomes a monthly optimisation process from analysing the results, seeing what insight that gives you, making decisions that drive corrective actions that get communicated through the business.

As you go through these monthly cycles you should hopefully be generating profit and cash far more effectively. Some changes might take time to flow through depending on the timescales of the financial mechanics of your business but it means you are always sense checking and adjusting activity against a target and if the target slips, you can course correct appropriately.

In conclusion

That gives you an overall view of how a mature financial component operates in a business. Please do come back to us if there's anything that you would like to talk about and of course if you’re just getting started on the planning for profit journey then you can take our free Profit and Cashflow Scorecard. It will take you five to ten minutes and give you a bit of an audit of your whole profitability and cash flow today.

When you’ve done that we’ll send you our Profit Calculator which is a free tool that in a simple way will enable you to target profit for the next 12 months. It's not as complex by any means as the Financial Mechanics Report© but is a good place to get started with setting a profit target and then adjusting some of the Core Drivers Of Profit And Cashflow© to hit that target.

To your success

Shaun

Ready to start planning for profit?

Complete our free Profit and Cashflow Scorecard to see where you are today and what steps you can start to take to get your business where you want it.