Financial control: When the buck stops it's always with you

I’ve never met a business owner who wouldn’t like more profit. What if I told you that it’s within your power not just to make more profit, but to double your profit in 12 months, or even less? You might think that sounds crazy and is going to be about the latest sexy marketing or sales tactic. You’d be wrong.

Profit is always driven by the finances of your business.

It all starts with Firm Financial Foundations

Firm Financial Foundations might sound distinctly unsexy to you right now, but as the owner of your business when it comes to money, the buck stops with you. And for me, having tight control of how my business generates profit, cash and how more of that cash ends up in my pocket is very sexy!

When it comes to finance, you might think ‘that’s a job for my accountant!’ or perhaps ‘I already know my business inside out - I started it!’

While many business owners thrive in their niche and can manage sales, marketing, product development etc. and the day-to-day management of their business in their sleep, lots fall down on the finances. Even business owners who are all over their accounts like a rash, still struggle with the right controls at the right times. It means sometimes they don’t see what’s coming down the track far enough in advance and so make poor choices or don’t take the right action at the right time to deliver the profit and cash they want.

The business owners guide to financial control

Without the right controls, at the right place, operating on the right time horizon, profit and cash can bleed out of a business from everywhere.

It’s for this reason that we’re creating The Business Owners Guide to Financial Control. A step-by-step guide to controlling and organising your finances at every stage of your business.

But why does any of this matter?

Businesses fail when Firm Financial Foundations aren’t in place.

"Only when the tide goes out do you discover who's been swimming naked."

- Warren Buffett.

The tide has certainly gone out in the last 12 months. In fact, it's going to get worse before it gets better, with reports that some 2.2m people, or 6.5 percent of workers, could be unemployed by the end of the year when the furlough scheme ends. Some companies have remained unscathed. Some have handed back furlough payments. Others are lost from our high streets for good. There have been moments of surprise for consumers as what were perceived as big fish turned out to be mere minnows, caught in tricky financial nets requiring administrators after just a month of low or no trading.

It got me thinking about the blame game. We can blame governments, nations, individuals, corporations, even the seasons and the sunshine (or lack of it) for our woes or mistakes, but in business, ultimately the buck has to stop with us, the owners.

To coin another phrase from Albert Einstein: "Any fool can know. The point is to understand."

My question to you is, with your current knowledge - are you setting yourself up for a fall?

Without Firm Financial Foundations – it’s your pocket that takes the hit.

If it goes wrong, it will be your business that suffers and your long-term financial provision that takes the hit. You can delegate the activities of financial control but not the ultimate responsibility. You must understand it and make sure that the overall framework is fit for purpose and that you retain overall control.

Don't believe me?

Take a look at Patisserie Valerie. You may remember that the chain went bust due to widespread accounting fraud with a black hole in its accounts of over £94m! While we all have blind spots, this was not picked up by the CEO, despite him being a well-known business guru dispensing advice in the Sunday Times. The collapse of that business led to 3,000 people losing their jobs. The company was valued at £450m, but went bust very quickly, wiping out the shareholder value, including that of the MD, who owned 37% of the shares. He even put in a further £10m of his own money to try and save it.

Many business owners’ retirement provision is heavily dependent on realising a good exit value for the business they’ve invested many years of their life building. That value can disappear if you don’t protect it. Understanding and taking charge of financial control is something every business owner needs to do.

Who’s job is it to manage the finances of your business?

Now is a critical time for business owners to go from ‘knowing’ their financial systems and processes to understanding them, because how well you control your numbers is key to both your survival and very importantly the money that ends up in your pocket.

In short, don't blindly rely on your accountant! While you are probably able to vouch for the fact that your accountant is both honest and competent, that's not always the case. Errors may come through deliberate fraud (Patisserie Valerie's finance director was arrested after the accounting scandal), but also there's a lot of incompetence out there. There’s also often a real mismatch of what a business owner wants from their accountants (business oversight and advice to grow profits) with what external accountants are set up to give (year-end accounts and tax) and what internal accountants are skilled at (preparation of monthly management accounts). Given accounting is a technical area, can you be sure your accountant is as good as you need him/her to be? How do you know?

The answer: A good understanding of the basics. If you and your family are relying on your business both for your income and your long-term financial provision, you cannot afford to ignore this subject.

How can you take control of your business finances?

I hope I have thoroughly scared you into accepting the importance of needing to understand the finances of your business.

Now, for the remedy. The good news is it can be relatively painless. We help businesses design and operate financial control systems, and we focus on identifying and developing key financial controls. The phrase I like is 'not to boil the ocean'. Don’t try and do everything, but focus on key risks and points of failure with key controls that, if operated properly, provide control and insight on the whole process.

The result? You have a robust analytical framework so that you and your people are aligned and are making decisions based as far as possible on facts. This then facilitates the cascading of good decision-making and ownership down the organisation so that the company becomes increasingly self-managed.

Getting started with controlling the finances in your business

So, where can you begin? We are creating a free step-by-step guide to help business owners understand the overall picture, find out where your major risks might be and what sort of controls you might need at every stage.

The Business Owners Guide to Financial Control will step you through each area of your business and the relevant controls you might need to manage the money flowing through your business.

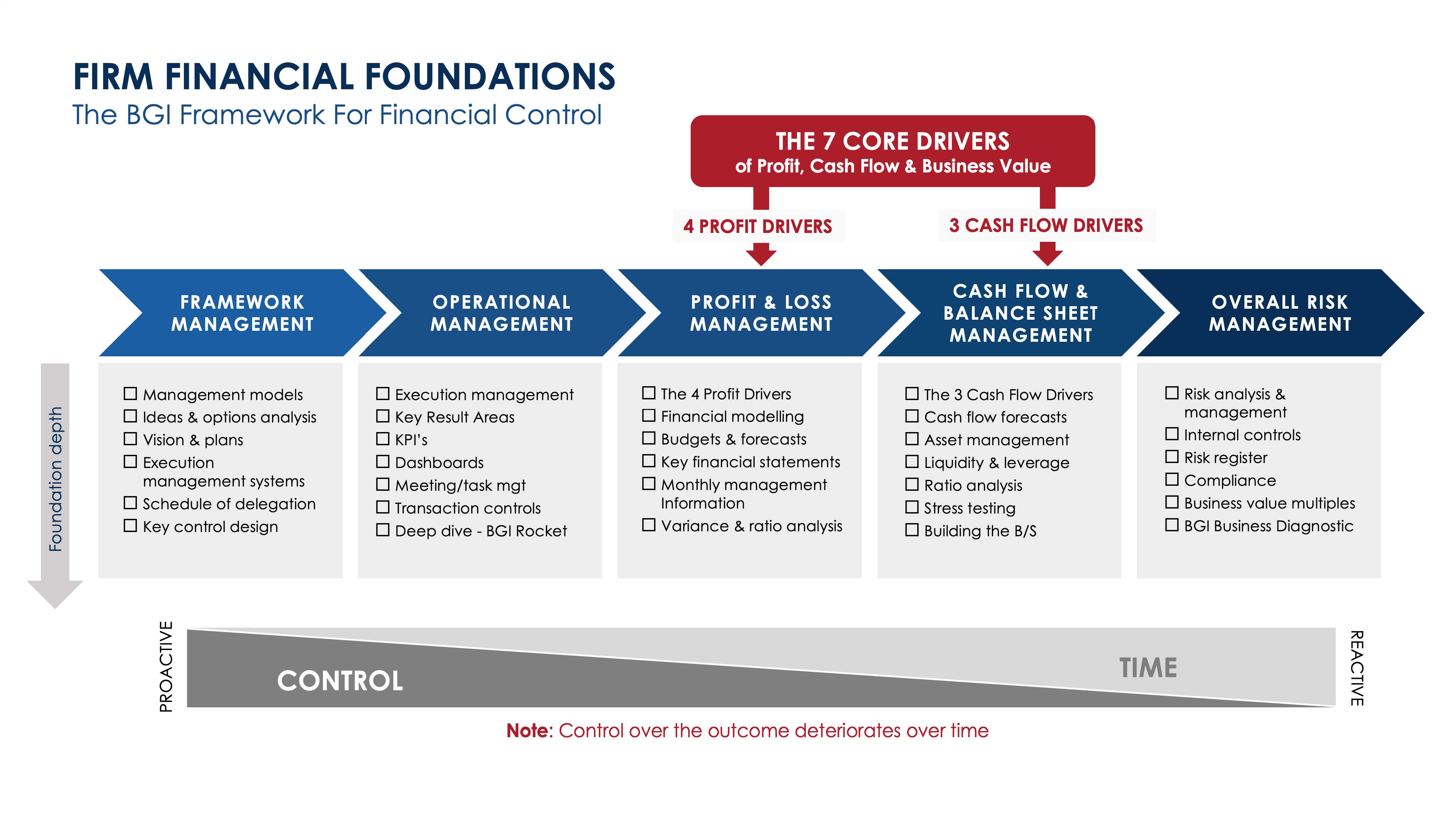

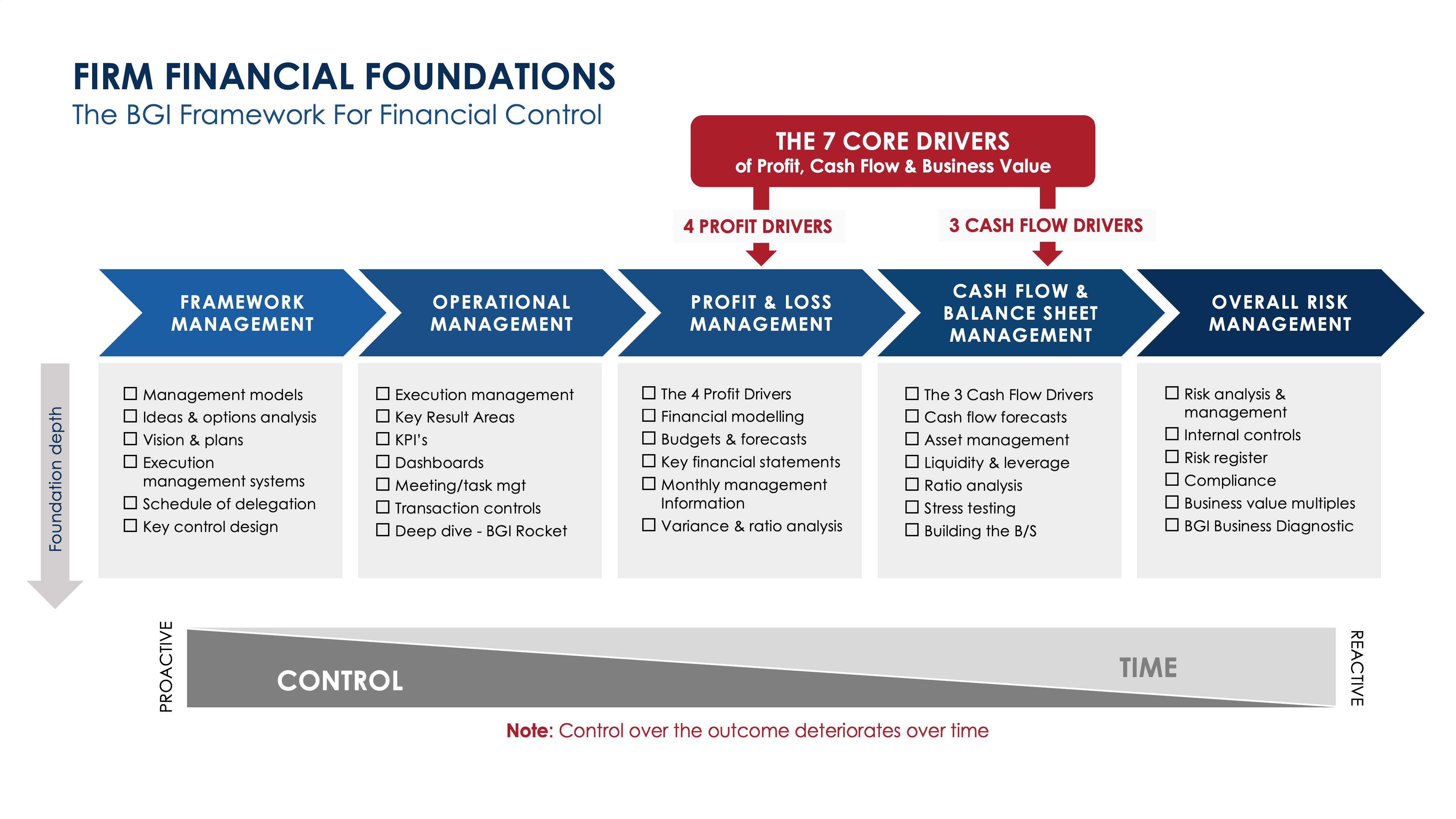

You can see the areas in our framework above so we will have detailed chapters on each of the areas in our Firm Financial Foundations Framework:

1. Framework management

2. Operational management

3. Profit and Loss management

4. Cash flow and balance sheet management

5. Overall risk management

Some of these may surprise you, but as you can see from our framework, in each of these areas you need different controls operating on different time horizons so that even the ideas and actions you and your senior management take are focussed on how they convert to profit, cash and money in your pocket.

You can get the Business Owners Guide to Financial Control as soon as it’s ready, simply by leaving your email here

Doubling your Profit

So, ask yourself does your business have Firm Financial Foundations? If you do, then you have the opportunity to achieve more than you had hoped. Over my almost 30 years in finance and consulting, I’ve helped businesses of all sizes, in pretty much every sector, to take tighter control of their finances and deliver profit figures that the business owners thought were impossible. Whether you are a small local business with a few £100k in turnover or a massive multinational, when you have tight control of your finances you can use that control to push and pull on the Seven Core Drivers Of Profit And Cashflowⓒ to generate profit and cash numbers that today might seem impossible.

If you're keen to understand how Firm your Financial Foundations are, then register for first access to the Business Owners Guide to Financial Control and we’ll let you know as soon as it’s ready in the next few weeks.

To your success

Shaun Walsh

Want to talk about any of this? Get in touch here.

Ready to start planning for profit?

Complete our free Profit and Cashflow Scorecard to see where you are today and what steps you can start to take to get your business where you want it.