The Seven Core Drivers of Profit, Cash Flow and Business Value©

Industry statistics show many SMEs are either profitable or making meagre profits. Our primary goal and passion at the Business Growth Institute is to help business owners change that.

Source: smallbiztrends.com

In fact:

- 30% of SME’s continually lose money

- 30% break-even

- 40% are profitable

In my experience, half of those profitable businesses are reasonably profitable, and half of those are creaming it.

That's borne out both by industry research and our long-term experience of working with literally hundreds of SME’s across many different sectors. I researched my client base recently and have personally worked with over 160 SME’s across 35+ different market sectors over the last 5 or 6 years. This is not just industry data but real-life experience working at the coal face with business owners.

I find that an absolute crying shame. The entrepreneurs who put huge amounts of blood, sweat and tears into their business are often the last ones to get paid. The business owners I work with are phenomenal people. They work very, very hard and take the risk of owning a business. They make sure their staff get paid before they do and when things do go wrong, they take a lot of responsibility, care and concern for their employees and the mortgages that are being covered by the salaries that they provide.

I just find it an absolute travesty that those business owners who work so hard, who give us jobs to provide for our children, who create the products and services that we rely upon in our daily lives, often don't get the rewards they are due.

That is one of the key missions of the Business Growth Institute. To help business owners make more money, get more time back with their families, make time to do some of the things that they've sacrificed over the years and reduce their stress.

There are a lot of different pressures on business owners I know. When things get really bad they don't sleep at night, they're worried about their personal finances, their family, their business and their employees. That’s a lot of stress.

Our central premise at the Business Growth Institute and what we believe will change this current reality for many business owners is the need to plan and execute around profit and cashflow. Setting the profit target you want to achieve and then reverse engineering your business around that.

The Financial Mechanics of Your Business

One reason for poor profit and cash flow is owners often don’t have a full grasp of how their business finances work. They’re rarely trained accountants and sometimes not well served by my profession. Business owners are happy to talk to me about sales, margins and profits, their P/L. Asking them how much cash they generated last month and why is another story.

I remember talking one MD through his P/L in a pitch meeting and just checking that he knew the difference between gross and net profit. He thought gross profit was what you get each month and net profit at the end of the year! I then looked at the B/S which showed net assets of £1.8m. Within 15 minutes I’d knocked £600k off that value. Dividends paid were treated as an asset and not a distribution. I think he understood the difference when I asked if he was going to pay that amount back.

He then said they were very tight on cash and could I help raise some working capital. He understood that having just reduced the net assets by £600k would not help that prospect. I then asked him about his debtors and found out they only invoiced on cash receipt (what we call cash rather than accruals accounting), not when the work was done. In effect, his debtors were off B/S and once we’d adjusted for this that added £850k back onto net assets! Talk about a yoyo. An interesting morning’s work!

I say this, not to embarrass neither this director nor any other business owner reading this who is uncomfortable with their numbers. This guy was no fool. He was the one with a £7m turnover business generating £1m+ profit pa, not me (not that I’m jealous or anything!). The issue is the lack of financial literacy at the top of a business can be deadly. It very nearly was in this case. The business ran out of cash, despite the good profits and very nearly went bust. What a shame that would have been for him, his family and over 70+ staff who would have lost their jobs.

One of the causes of the lack of financial literacy is that business has a lot of moving parts and the accounting can get quite complicated, particularly as you grow and you don’t have an experienced FD to control the business and help you understand the finances. One of my goals at the Business Growth Institute is to cut through all of that and make the numbers simple. It is our passion that otherwise solid businesses don’t go down the pan, with all the pain and heartache that come from that. We help build Firm Financial Foundations© so the business can thrive providing income, security and opportunity for its staff and the deserved rewards in money, time and less stress for the risk its owners bear and the sweat they put in.

To that end then, let's leave the P/L and B/S for a moment, and consider a graphical framework of how money flows through the business.

I covered this concept of the Financial Mechanics of a business in an earlier blog, so if you haven’t read that yet go and do that before reading on as understanding the flow of money in any business is fundamental to moving forward with what we are going to talk about today.

The Seven Core Drivers of Profit and Cashflow©

In the last blog, we looked at a mature financial component and introduced The Seven Core Drivers of Profit and Cashflow©. They are:

- Price

- Sales volume

- Direct costs

- Overheads

- Debtor days

- Stock days

- Creditor days

It is these seven levers that you and your management team can pull to drive your business from the financial results it’s currently delivering toward your target profit number.

Today I’m going to demonstrate to you how planning, controlling and executing around these drivers really can Double Your Profit In 12 Months….. Or Less©. This is the key challenge we work on with our clients. It might sound crazy but it is very possible, we have done it many times and we have a proven process to help you do it. Indeed if you really grip your numbers, you may also be able to triple your yearly positive cash flow which combined with the profit increases can increase your business value five or more times.

If you’d like to know how to do that, read on.

What I’m going to show you is the process we work through with clients in a detailed forensic manner. If you're not yet lucky enough to be a client of ours but you’d still like some help, we’ve developed a free tool for you, the Profit Calculator© pictured below.

Simply complete our free profit and cash flow scorecard which will give you an overview of your businesses position today then we’ll send you the Profit Calculator© so you can go about starting to plan for the profit and cash flow numbers that you want and start you off on your journey.

The Financial Mechanics Report©

What we're going to look at now though is a far more comprehensive model than the Profit Calculator, which we call The Financial Mechanics Report©. This model helps us identify the impact on a business of changes in The Seven Core Drivers of Profit, Cashflow and Business Value©. I’m going to show you how making small changes to each of these numbers can add up to a massive impact in your results.

We’ll use a case study below which is from a £25m turnover business I looked at buying some years ago. Unfortunately I wasn’t successful. Read to the bottom and you’ll see why!

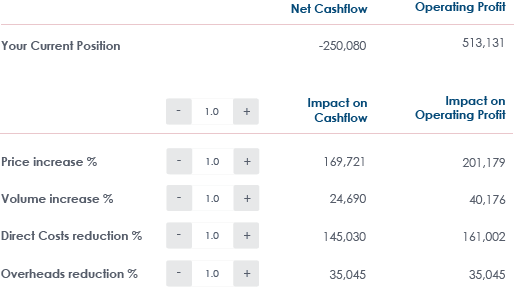

Interestingly, the business was making £513k operating profit but was cashflow negative. Not untypical. That’s a blog for another time, but profit and cashflow are not the same things. Your business can be making profit while sucking up cash. More companies run out of cash and go bust when they’re growing then when they’re not. Far better to be cashflow positive as you grow, but if that’s not possible you certainly need to understand the effect on your working capital needs that growth will generate.

Our model shows how small 1% changes or one day changes across the Seven Core Drivers impact profit and the cash flow of the business over the next 12 months.

The 4 drivers of profit

There are 4 drivers of profit:

- Sales Price

- Sales Volume

- Direct costs

- Overheads

Increasing price

The first profit driver at your disposal is increasing price.

In this particular case, if we increase price by just 1% we can see that all other things being equal, that improves operating profit by £201k. The way the Financial Mechanics of this business work means that will also increase cash flow by £170k.

Increasing sales volume

The next choice in business is to increase sales volume.

In this business a 1% increase in sales volume generates a £40k increase in operating profit and £25k in net cash flow.

It is often the case that increasing price is a lot easier than volume. In addition given a price increase does not incur any increased direct cost, a 1% increase in price generates more profit than the same increase in volume. Despite this, many directors I advise are reluctant to increase price, fearing their clients would walk. Pricing and customer psychology is a whole other topic but suffice to say it is more often the fear and limiting beliefs of the owners than the actual response of customers which means businesses lose out on this relatively easy win.

If you're looking for profit and quick wins increasing price is generally the fastest thing you can do to increase your profit and cashflow.

Reducing direct costs

So that's revenue. The next thing to consider are direct costs. These are also called cost of sales or cost of goods sold in the trading account of the P/L.

In this particular case a 1% reduction in cost of sales will generate £161k of incremental operating profit and £145k of cash.

Reducing overheads

Next we look at the overheads of running the business or the expenses.

In this case a 1% reduction in expenses will generate £35,000 worth of profit and cashflow.

The 4 drivers of profit…which do also flow into cash

These are the 4 drivers of profit. Profit increases also flow into cash (or should do) so the 4 drivers also impact cash flow. There are only 4 and that is the same in any business. Our aim is to keep the numbers simple. I don’t care if you have a North Sea oil rig, a local sweetshop or you’re the Bank of England (well that's probably a bit more complicated), the 4 drivers are the same.

Having said that, the actions you might take in different businesses in different situations to move those numbers will vary significantly from business to business.

What I’m not saying is that increasing profit is as simple as making an assumption in a model. Implementing the changes and delivering the anticipated results require wisdom, energy, a grip on each area of the business and perseverance. Simple to model it may be, easy to implement it may not be.

If I start out from where I live in Nottingham to go to London, I need to know the direction. It doesn’t matter how many hours I walk, how many sleepless nights I have, how much I pay people to get me there faster, if I don’t know the direction and have a clear map, I’m not going to get there. Certainly not any time soon nor in any decent shape to enjoy it when I get there.

What I am saying is this model provides the start of the map to get your business generating the profit and cash flow you want.

Now to the balance sheet and the 3 pure cash flow drivers

As I mentioned, business owners I speak to often, don’t really understand what their balance sheet tells them. My profession has complicated it and frankly not helped. It is a passion of mine to change that.

Amongst other things, the balance sheet shows you how fast you turn whatever profit your business is making into cash.

There are 3 drivers of cashflow, sometimes called working capital drivers:

- Accounts Receivable (Debtor) Days

- Stock or Work In Progress (WIP) Days

- Accounts Payable (Creditor) Days

Reducing accounts receivable days

The first thing you can do is reduce the time it takes on average to collect from your customers. We measure this in accounts receivable days.

In this business every day that you can collect cash faster will generate a positive cash flow of £55k. That is £55k in your pocket rather than your customers.

Accounts receivable days is basically your accounts receivable (net of VAT)/your sales (net of VAT) which shows how many days of your annual sales you’ve not yet been paid for. As one of my former clients was fond of growling at his staff, “A sale is a gift, until it’s paid for”.

A typical accounts receivable days might be that it takes you on average 45 days to collect your cash from your customers. In this particular business if you reduce that from 45 days to 44 days, this will generate an additional £55k of positive cash flow.

Reduce Stock or Work In Progress (WIP) Days

If you’re a goods business you might have money tied up in items of stock or if you make things, work in progress. If you’re a service business you may be delivering a service but not invoice it until later (also called WIP). The Stock or WIP days shows how many days on average you're holding that stock for or working on it for, before you invoice the customer. At that point it moves over to the accounts receivable driver.

In this business a reduction of WIP of 1 day generates£55k of positive cashflow pa.

Increase accounts payable days

The third cashflow driver, or working capital ratio, is your accounts payable days. This is the corollary to the accounts receivable. While Accounts Receivable days is, on average, how many days it takes you to receive cash from your customers your accounts payable days is, on average, how many days it takes you to pay your trade creditors.

Let's say this company normally pay their trade creditors in 45 days, potentially even longer. If they could increase that from 45 to 46 days, that would generate £44k positive cash flow pa. Delaying payment to creditors is one of the easiest ways to conserve cash in the short term, but should be used carefully in order not to deteriorate your key supplier relationships.

The compounding impact on profit and cashflow

What you can see with all of this is that even with very small changes across those seven drivers or ratios, when you total it up it will increase the profit of this business by £437k from £513k to £950k. Even with those small marginal changes you're getting close to doubling your profit.

Now, that's not always the case. The financial mechanics in a business might be such that you need to make bigger adjustments, but in this particular case small adjustments in all of the seven core drivers actually have a significant impact on profit.

These changes also have a significant impact on cashflow. The first four profit drivers (which appear on your P/L) have an impact cashflow as well. That’s because if you're making more profit, that will of course flow through into cash.

Note that the last 3 cashflow drivers (which appear on your B/S) don't operate the other way to affect profit, they only affect cashflow. E.g. If you invoice a customer for a product which costs £10k and it costs you £7k in total to make and sell that product, that's a £3k profit. Now, whether you collect that £10k from your customers on day one or day 45 it isn’t going to affect profit, it's always going to end up being £3k. However the earlier you collect the £10k and the later you pay the £7k will affect your cashflow.

Hopefully this demonstrates how critical understanding, planning for and controlling all of your seven core drivers, 4 on the P/L and 3 on the B/S, can be to the results of your business.

Case study: £25m T/O business

Let's take the company above and walk you through how we approach this process with our clients and acquisitions. We start by stepping through each of The Seven Core Drivers of Profit and Cashflow© with the senior management team, discussing and agreeing what changes to each are feasible. In this case we ran the numbers with our buy-in team as we didn’t want the seller to know how we thought we could turn it around!

So here we have that same company but with the agreed numbers with our team. Note it's actually a slightly different accounting period in this example so the starting position is slightly different but the principles are exactly the same.

In this particular case, our team were thinking that we could actually increase prices by 4% and be quite happy that we wouldn't be losing customers as a result. The impact on the operating profit and cashflow of doing that was £810k and £672k respectively.

We thought we could increase sales volume by 15%, again with significant impact.

For various reasons we didn't think we could reduce the direct costs so there's no change on that component as a percentage of their sales.

We also expected that to drive the uplift in sales volume we would need a 5% increase in marketing and sales overhead. That had a negative impact on profit and cashflow of £183k. As an aside, in any business without such aggressive sales volume increases, I would find it very difficult to imagine that you wouldn't be able to reduce your overheads by 5%.

On the cashflow side the team thought we had a lot of scope to reduce accounts receivable days. We didn’t see any scope for days of work in progress, and only a small increase in accounts payable days.

The important thing here is that the team was involved in discussing and agreeing these numbers. It's one thing to set goals that are unrealistic or that nobody thinks can be achieved, but when you as a business owner set these goals with your management team and have the challenge, discussion, debate, buy in or argument, etc. what you finish up with is a position which has your management bought into and a commitment to achieve.

The changes agreed by the team were going to increase the operating profit by £1.2m from £641k to £1.9m and cash flow from £294k to £1.8m. These are big numbers.

Now, you might be looking at this and thinking ”An increase in profit from £641k to £1.9m, yeah right Shaun, pull the other one!”

Well actually, no. This was a £25m turnover business in need of someone to take it by the scruff of the neck. An operating profit of £641k is a net profit percentage of 2.5%. The increase to £1.9m only moves that to a very realistic 7.6% net. Not unrealistic at all with far more money on the table to be had in later iterations.

The Impact on Business Valuation

Of course improving profit and cashflow doesn’t just make a business more sustainable it also has a profound impact on the business valuation.

I mentioned above, this was a business we were trying to buy. I was gutted we weren’t successful with that. Why? Had we bought it for £3m and turned it around to the extent we planned, that would have then been worth nearly £9m! Better luck next time!

This applies to every business. The numbers may be different but the principles are exactly the same

You may be thinking “Well Shaun, that's great for a £25m turnover business, but my business is a few £100k, a £1m or £2m. Those are big numbers and this isn’t going to work for me until I get to £25m turnover.”

Rubbish!

The numbers may be different, but the principles are the same. Take a look at the same approach with a much smaller business.

The client above was doing about £1m turnover but not making much profit with an EBIT (Earnings Before Interest and Tax) of £7k and negative cashflow of £7k.

It’s not that she wasn’t making money. She was earning a director’s remuneration of about £60k pa but this was as a manager working in the business, not profit as a business owner. She was also working quite hard to achieve those results and wanted to spend more time with her children.

She approached our process with some scepticism. However I was able to show her that small changes in the core drivers, which importantly she felt she could achieve, would increase her profit by £93k and cashflow by £99k. In addition for the first time this business would have some value.

These impacts were nothing like the quantum of the previous example but in terms of impact, they were life changing. In fact, I find these sort of changes in the lives of clients who are struggling, far more satisfying than the big numbers for those who already have plenty.

So, how about you?

Are you generating enough profit and cashflow in your business? What would you like to generate in the next 12 months? How would life change for you and your family if you could achieve those numbers?

Could you do with some help in planning how to do that? Maybe a second opinion? Do you really have a grip on your numbers? Are you on target?

If you’d like some focused help from us with this do have a look at The Financial Mechanics Report©.

If you’d like to have a look at how you could adjust some of these levers on your own, they get our Free Profit Calculator© tool which we’ll send you when you complete our Profit and Cashflow Scorecard©.

To your success

Shaun

Ready to start planning for profit?

Complete our free Profit and Cashflow Scorecard to see where you are today and what steps you can start to take to get your business where you want it.